RESEARCH

New Frontiers in Value Creation | February 2024

ICM and Tideline report “New Frontiers in Value Creation” shows how impact can drive financial outperformance. The key concept introduced in the report, impact value creation, defines actions investors may take as owners, lenders, and influencers to enhance impact efficacy.

This report is the latest in the “Alpha in Impact” series, launched by ICM in 2018 to explore the various ways in which impact objectives may enhance financial value for investors throughout the investment management lifecycle.

Alpha in Impact: Strengthening Outcomes Impact and Financial Value at Exit | May 2023

ICM, Morrison Foerster, and Research Fellow Divya Walia published a new report, “Strengthening Outcomes: Impact and Financial Value at Exit,” that shows almost two-thirds (65%) of impact exits meet or exceed financial performance expectations. The first-of-its-kind study draws on a sample size of 230 exits from ICM members, each of which manages a market-rate impact fund and is therefore uniquely positioned to provide data and insights into the success of impact exits and the key drivers of that success.

This report is the second in a series that explores different aspects of impact investing and how an impact-focused approach can generate alpha for investors.

What’s Next For Fund Administration | January, 2023

Fund administration is a common concern of both impact and traditional fund managers. With this project, ICM sought to understand how fund administration currently works at funds, the diversity of current market offerings, what would improve functionality and value from the managers’ perspective, and whether impact funds have unique needs that could be better served by existing or new products and services.

This study, conducted by Lauren Washington (ICM Fellow), employed a mixed-methods approach, including an initial focus group, nine interviews, 38 survey responses, and secondary research.

Legal Innovation in Impact investing | April 2021

A study by Morrison & Foerster and Impact Capital Managers details a variety of legal tools and processes used by private capital investors to protect and enhance impact investments. The report highlights diverse strategies pursued by impact investors to substantiate their goals; identifies new set of innovative legal tools; and examines how investors have responded to the COVID-19 pandemic and renewed urgency to advance racial equity.

The “Legal Innovation in Impact Investing” report is the culmination of a comprehensive research initiative conducted over the last year by ICM Fellow Daniel Irvin of Stanford Law School, under the direction Susan Mac Cormac and Kaela Colwell of Morrison & Foerster. The study draws on quantitative and qualitative data provided by members of Impact Capital Managers. The report builds on existing open-source resources, including the Toniic Impact Terms Project, by sharing fresh examples, innovative applications of existing tools, and emerging best practices from venture capital and private equity investors currently active in the impact investing field.

Anchors Aweigh: Analysis of Anchor Limited Partner Investors in Impact Investment Funds | June 2020

Research from ICM and Shawn Cole and Rob Zochowski of Harvard Business School analyzes “impact anchors” - the handful of foundations, insurance companies, banks, and other investors who are keystones in new market-rate impact funds. The study focuses on identifying the limited partners who make up this landscape and better understanding their practices and motivations. In Anchors Aweigh: Analysis of Anchor Limited Partner Investors in Impact Investment Funds (pdf), the authors surveyed 13 fund managers (28 funds) within the ICM network, and conducted qualitative interviews with six anchor investors.

The paper was written by Shawn Cole, the John G. McLean Professor at Harvard Business School; Rob Zochowski, program director of the Social Impact Co-laboratory and the Impact-Weighted Accounts Projects at HBS; Fanele Mashwama, a research associate at HBS and Harvard University; and Heather McPherson, MBA candidate at The Fuqua School of Business at Duke University and former ICM Summer Associate.

Read the Q&A with Cole & Zochowski in HBS Working Knowledge.

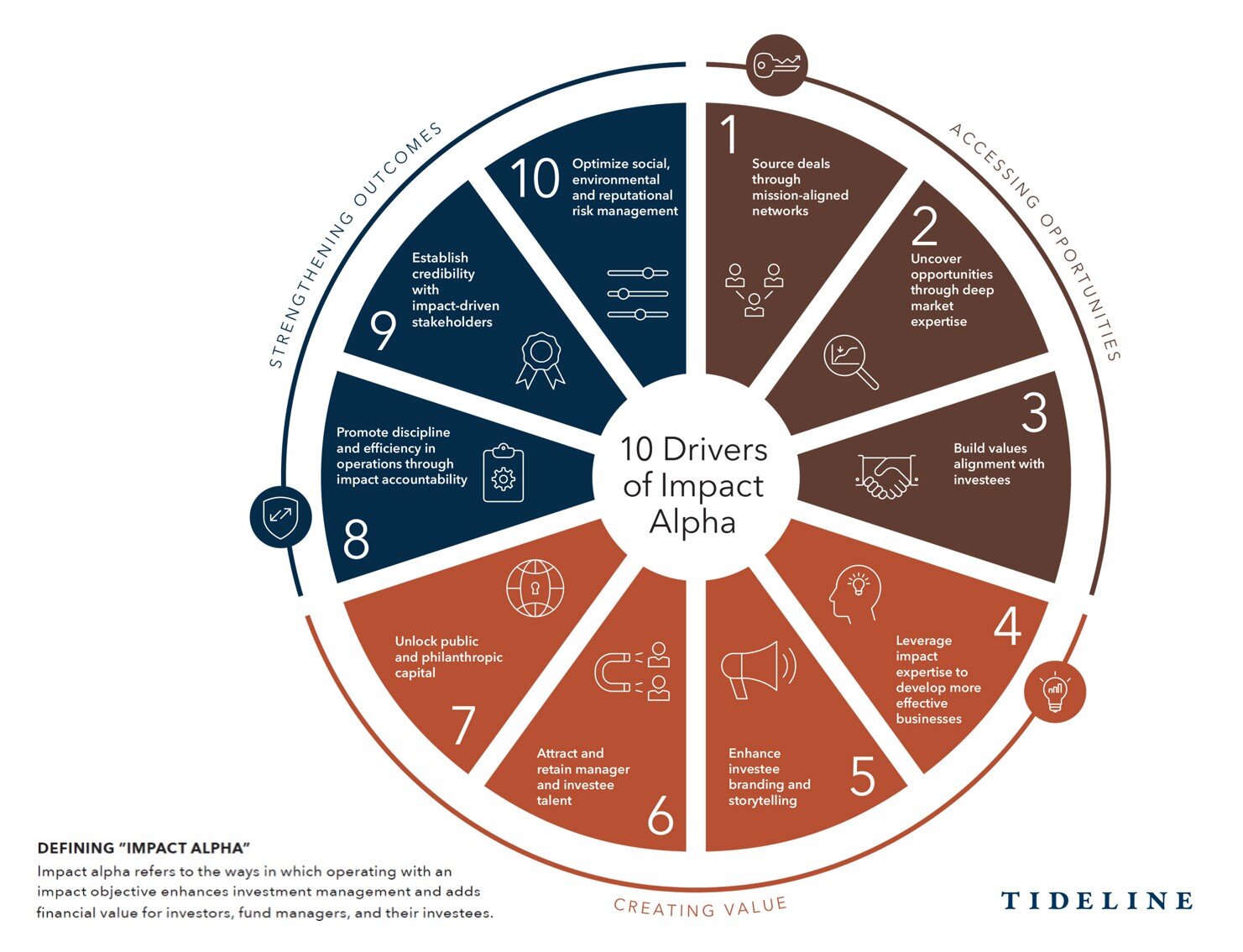

The Alpha in Impact | December 2018

Research from Tideline and Impact Capital Managers shows that a social and environmental focus on investment management can boost financial returns. The white paper The Alpha in Impact, published in 2018, is based on Tideline’s analysis of nearly 30 financial transactions from ICM-member investment portfolios. The analysis uncovered 10 unique drivers of “impact alpha,” defined as the ways in which operating with an impact objective can enhance or add financial value for fund managers, investors, and the firms in which they invest.