IMPACT MEASUREMENT & MANAGEMENT

Impact investors set themselves apart from traditional investors because of their objective to invest for both financial returns and impact. A successful impact measurement and management (IMM) practice can enable investors to enhance their impact, increase their business value, and communicate more effectively.

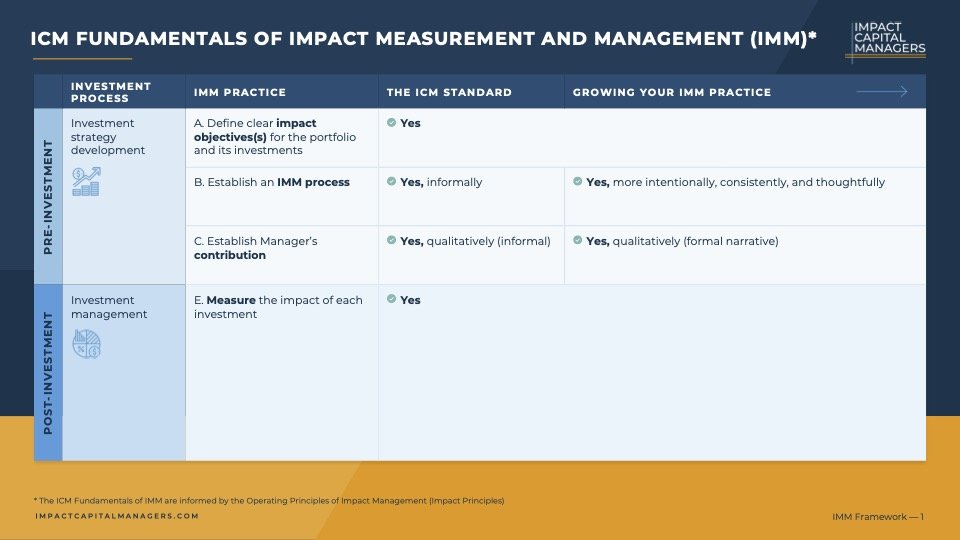

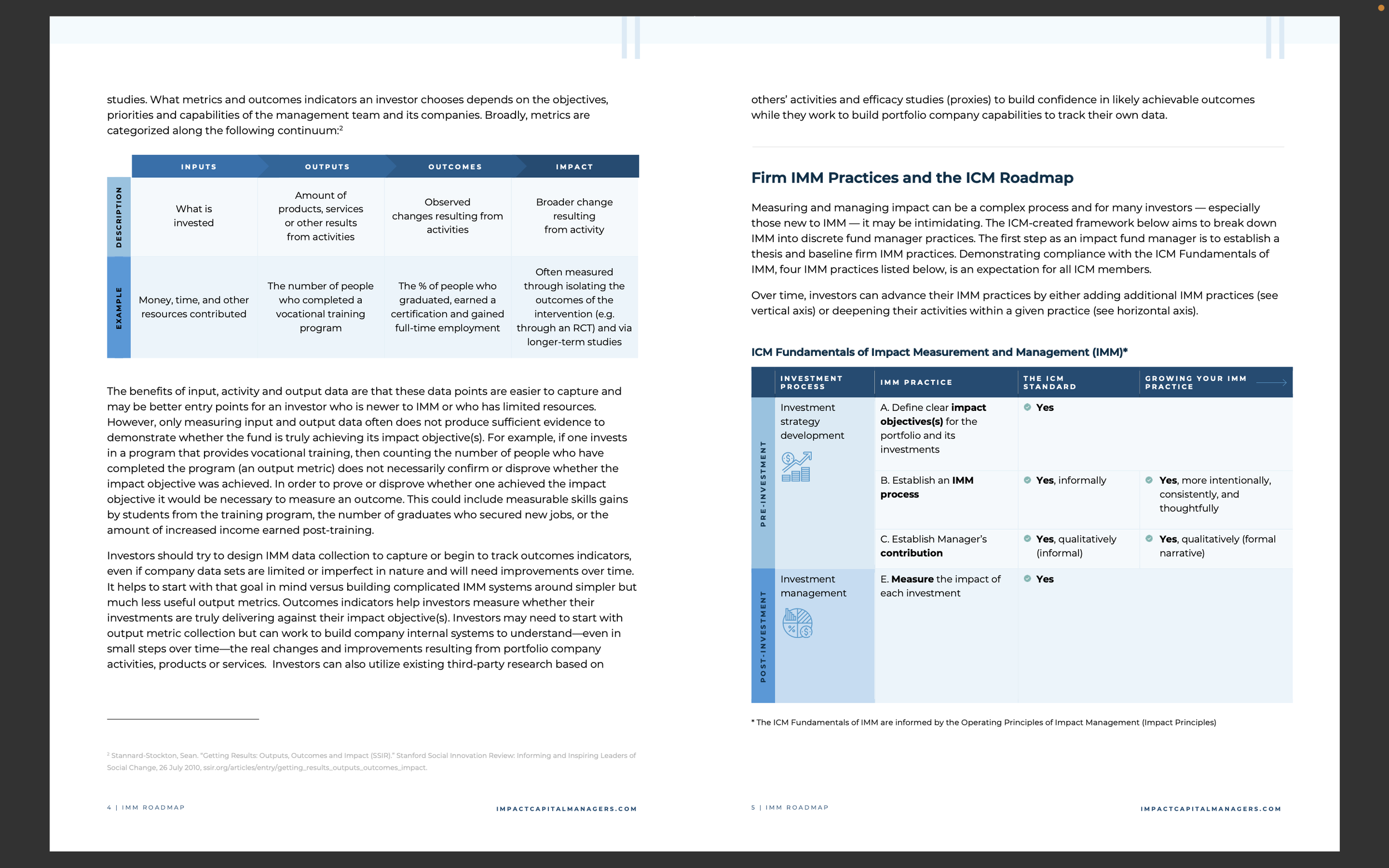

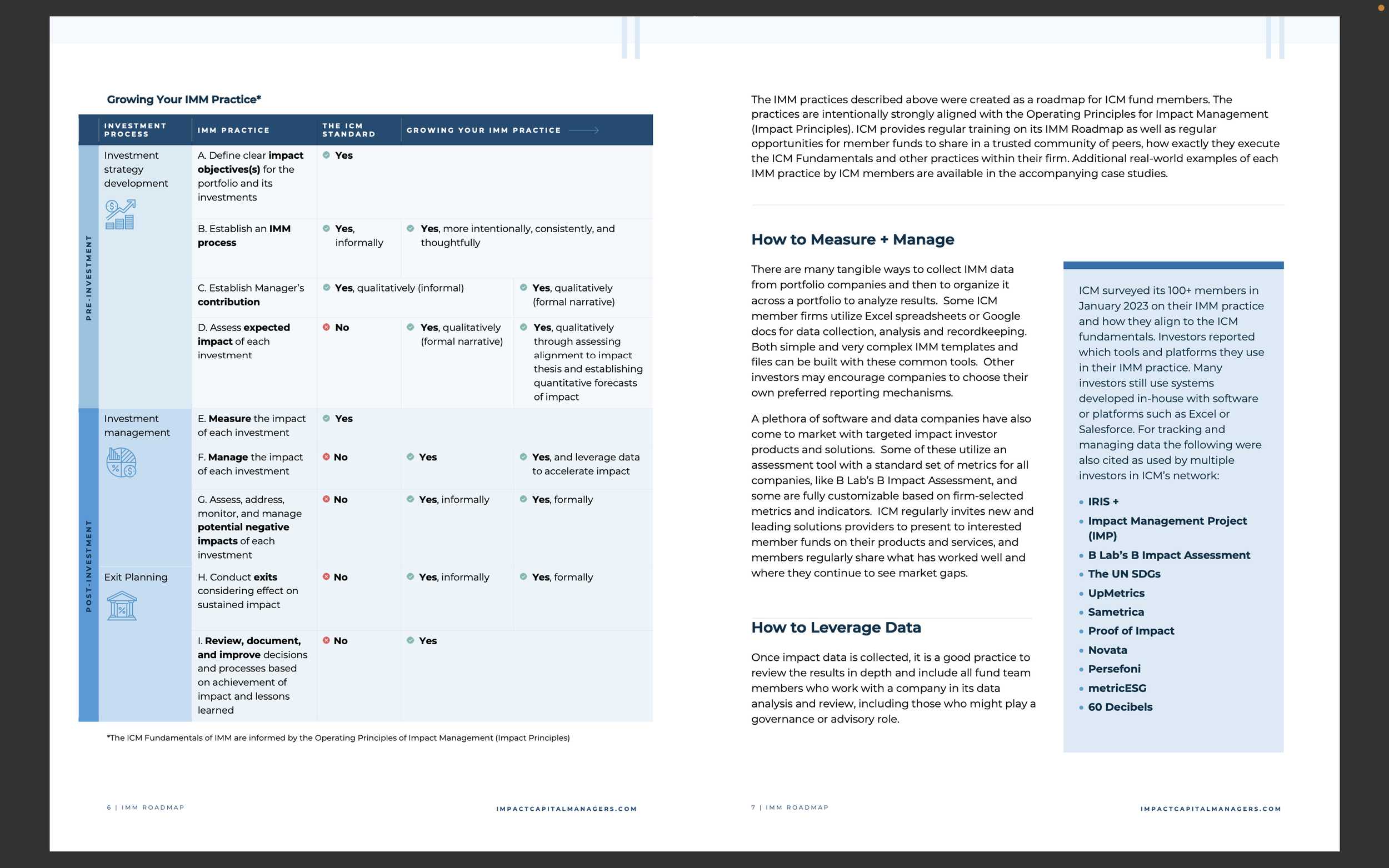

The “ICM Fundamentals of IMM” were generated in 2020 by leaders in the ICM network to set a high but achievable bar for a variety of private capital fund managers seeking both superior returns and meaningful impact. Together they comprise a solid floor on which fund managers can build a more ambitious and effective practice over time.

The ICM Fundamentals of IMM (see right):

Helps investors define what is useful, practical, and important;

Support ICM members to become more sophisticated and effective investors; and

Ensures continued quality of ICM’s best-in-class network, by embedding expectations for IMM in criteria for inclusion.

IMM Resources

Impact for Decision Making: An Online Curriculum on Impact-Financial Integration

This online resource provides a guide through the concepts, processes, and tools investors need to optimize portfolios for integrated impact and financial goals. The curriculum synthesizes the insights and learnings that emerged from a partnership between ICM and Impact Frontiers and with the generous support from the Tipping Point Fund.

The curriculum is designed to lead investors through the five steps of impact-financial integration, which are:

Set up an impact rating

Identify a risk-adjusted financial return metric

Construct and analyze integrated investment scatterplots

Synthesize decision-making rules

Communicate performance

A Roadmap to Impact Measurement & Management

Impact measurement and management (IMM) is a critical component of every impact investor’s practice. In its simplest sense, IMM is how an investor gathers and applies data to maximize positive impact and minimize the negative impact of one’s investment. It is also how an investor determines if it is meeting its intended impact goals or not.

This roadmap is built by ICM members and serves as a tool to help investors better understand where their IMM practices are today and identify actionable steps they can take to improve.

Case Studies: Impact Measurement and Management Spotlight

The following case studies illustrate how the IMM practices of four ICM members align to the ICM Fundamentals of IMM. The funds featured here represent a diversity of asset classes, investment stages, and impact themes. ICM will add to this library of case studies on an ongoing basis. Click on the images below to download.